The guide to text marketing for insurance agents

Text messages are the future of insurance agency marketing. Learn how to use SMS marketing to win new leads and keep your current clients.

If you’re here, I’m going to assume three things.

First, you’re an insurance agent. Second, over the last few years, you’ve gotten tired of people not picking up the phone or responding to your emails. Lastly, you know that people are glued to their phones and you’re considering texting them.

You’re not alone. Every week we speak with insurance agents who want to use texting for everything from following up with leads to sending appointment reminders.

So, why have top-performing agents aggressively adopted SMS?

Why should insurance agents use text message marketing?

Marketing channels are changing quickly, and you’ll need to stay ahead of the curve to adapt.

As we mentioned, your customers prefer to text. Here’s a look at the way text message marketing can help you meet the demands of your market.

People don’t answer their phones

87% of customers won’t answer their phones for a number they don’t know. That means you could spend a lot of time and effort calling customers with very little result.

Text messages, on the other hand, have a 45% response rate. You could generate as many as 23 conversations when you send 50 text messages.

The results plus the time you get back make texting an unrivaled communication channel.

Text messaging outperforms email

Even if you rely on emails to connect with customers, consider the following:

- The average open time for text messages is 90 seconds, compared to 90 minutes for email.

- Click-through rates on text messages are around 10.63% vs. 2.6% for email.

People Are Already Texting You

Every day, 150 million texts are sent to U.S. business landline numbers that can’t accept texts. So, whether you know it or not, people are already texting your phone number.

The good news here is that we can text-enable your existing landline since your customers already know and trust it. You can make and receive phone calls and still send and receive SMS.

In short, you can’t help a customer if you never actually reach the customer.

When you sell insurance, you’re helping people protect their future and their loved ones. It’s a personal business that requires a personal form of communication when connecting with clients and leads.

That’s where business texting comes in.

When making the case for business texting, two stats stand out from all the rest:

- 79% of consumers have opted in to receive texts from businesses this year (representing an 11% growth in SMS marketing opt-ins year over year).

- Only 30% of consumers report actually receiving texts from the companies they work with

For savvy insurance agents, this disconnect between what people want and what businesses offer is a major opportunity.

Now that you know why, the rest of this guide will show you how insurance agents and agencies use text message marketing and how to get started with SMS.

What is insurance text message marketing?

Insurance text message marketing is, very simply, the practice of spreading the word about your insurance agency and streamlining your processes using texts.

Every agency uses texts differently, but they’re useful for bringing in new leads, reaching existing customers, and communicating crucial information like policy changes and alerts.

In fact, SMS is one of the most affordable and surefire ways to improve your overall customer experience. You can:

- Follow up with leads

- Answer quick questions

- Book meetings

- Send reminders or notifications

- Start conversations from your website

If you’ve got information your customers should hear, text marketing is for you. People trust their insurance companies with their money, their health, and their lives. Make sure your customers get the details they need quickly and reliably with texting.

How insurance agents use texting

No matter how much technology develops, insurance is all about establishing and managing relationships.

The key ingredient of any good relationship is communication. Texting offers busy agents a quick and effective way to:

- Communicate 1-on-1 with leads, customers, and clients

- Send updates in the form of text blasts to a list of contacts

The best part is, with an SMS insurance marketing service you can check both of these boxes in one browser tab.

We’ll cover what both functions look like in more detail.

Converting leads with text message marketing

We’ve covered a few of the basic things you can do with texting and why they work, but how exactly can you put SMS to use in your insurance marketing strategy?

Here are five ways you can use text messaging as an insurance agent.

1. Text 1-on-1 with leads, customers, and clients

Many SimpleTexting customers use texting to communicate with leads generated from other marketing channels like their website and social media ads. That’s because:

- They can interact with prospects who may not be able to send an email or make a phone call at work.

- Texts allow potential and current customers to respond at their convenience with no pressure.

- Agencies can contact a lot of people in a short amount of time and get the highest number of responses possible.

The simplest way to encourage these 1-on-1 interactions is to advertise the phone number you typically use to take questions.

From there, you can organize and respond to these incoming messages. Here’s how two-way texting works.

2. Use SMS to book phone calls or meetings

Jake Irving, the owner of ClueRX, has his agents immediately follow up with a phone call when they receive a new website lead.

If the lead doesn’t answer, they’ll send a text message like this.

A similar strategy has helped increase Heart Life Insurance’s contact rates from 27% to 41%.

3. Answer quick questions

Set up your account to receive notifications of incoming messages instantly so you can answer any important questions or texts right away (the data tells us that a fast response time is vital to your success).

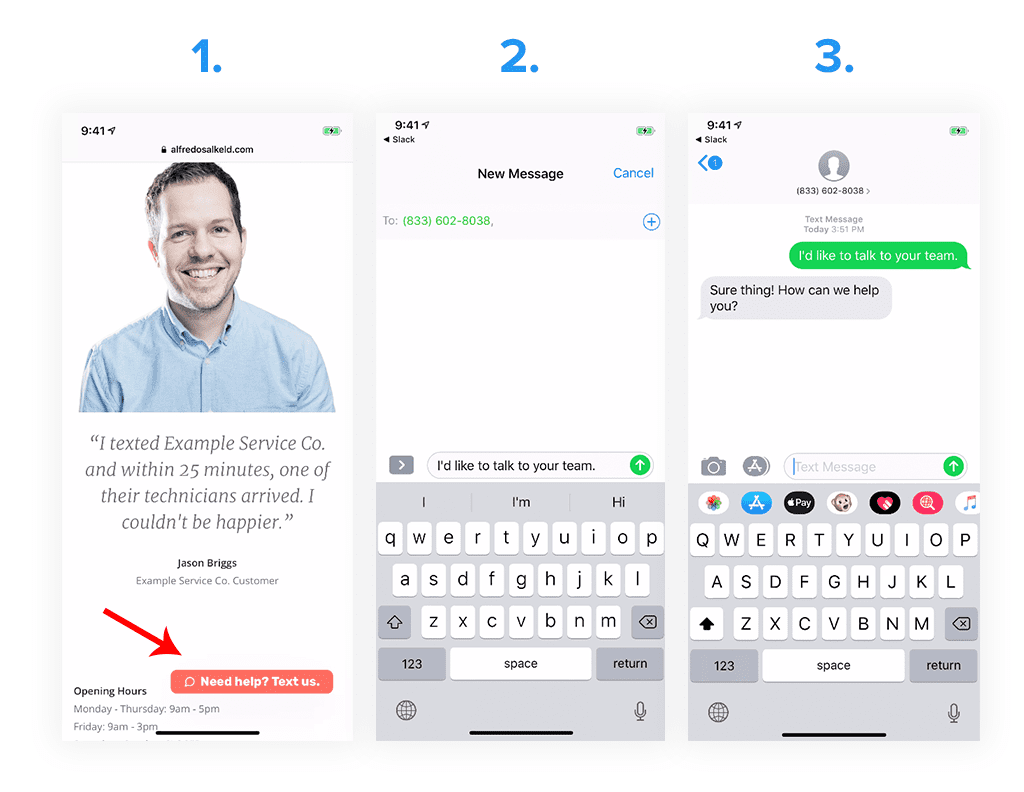

4. Add texting to your website

Jimmy McMillan, the owner of Heart Life Insurance, notes that texting helps humanize the insurance process and is more intimate than an email.

When texting 1-on-1 with clients, keep messages simple and easy to respond to. “Yes or no” questions and “this or that” options work better than open-ended questions.

For example, a great text would be, “Would you rather I call you at 2:00 or 6:15?” versus, “When would you like me to call you?” because it takes less effort on the prospect’s side to respond. You can also send text messages to give clients updates and notifications.

If you want to turn more of your mobile website traffic into potential customers, you can add a Click-to-Text button to your site.

When a website visitor taps the button, the SMS app on their cell phone will launch with a pre-written message as well as a pre-filled phone number.

5. Automatically send texts to Facebook or web leads

Many agents we work with also connect their Facebook Lead Ads or web forms to SimpleTexting so that they can automatically send a text message to new prospects.

The benefit? Instant response times that leave a positive impression on clients.

How to get started with SMS insurance marketing

Now you know all the things you can accomplish with text marketing, but the question remains: Where do you start?

Here are a couple of steps you can take to set yourself up for text marketing success.

Choose an insurance texting platform

First things first — you’ll need to find the right texting software to support your SMS strategy.

While you could send individual texts from your phone, a texting platform gives you a few very important advantages.

- You can avoid giving your personal number out to clients or prospects, which helps maintain a healthy work/life separation.

- You can message hundreds or thousands of contacts at once or hold one-on-one conversations.

- SMS platforms let you create, send, schedule, and automate messages.

How to choose the best SMS insurance marketing service

We’ll state the obvious: we’re an SMS insurance marketing service. We’ve worked with thousands of agents to help them text their leads, clients, and customers, but we’re not going to do any hard selling here.

We encourage you to research SMS platforms, read plenty of reviews on third-party sites, and sign up for a free trial before you commit to one.

If you’re only starting to research SMS services, here are some of the boxes you’ll want to tick when choosing a platform:

- Can they text-enable your existing phone number? SimpleTexting can text-enable an existing landline, VoIP, local, or toll-free number for you (and help you get your toll-free number verified and your local number registered).

- A lot of text messaging platforms allow you to either text 1-on-1 with customers or send bulk texts. You want a platform that will allow you to do both.

- Do you need to integrate with other platforms like a CRM or send automated text messages? If so, you’ll want a service that offers multiple SMS integrations and automations.

- Insurance agents need to be careful of services that limit the number of keywords you can create (we don’t.)

- If you plan on using an SMS insurance marketing service for two-way messaging with customers, you’ll need an SMS inbox with the juice to manage multiple conversations.

The final piece to consider is cost. The per-message price is a huge factor. It’s also worth finding out if credits roll over from one month to the next.

Create and schedule your texts

Now comes the fun part: writing up and sending your texts.

If you’re using a text marketing platform, you have lots of choices in the types of texts you can send and how you send them.

- Mass texts – Also known as campaigns, these are texts you send out to some or all of your contacts. Mass texts are best for important announcements or updates.

- Inbox messages – These are one-on-one messages to individual contacts. Inbox messages work well for customer service functions and individual questions or notifications.

- Autoresponders – Autoresponders are texts that send automatically at a set time or when a contact performs a specific action, like joining your list. Use these to ensure that contacts hear from you consistently and promptly, and to give out information like business hours or the best way to contact you.

- Scheduled texts – You can set texts to send automatically at your desired date and time. Depending on the platform you use, both campaigns and individual inbox messages can be scheduled ahead of time.

Insurance marketing message examples and tips

Text blasts are often underused by insurance agencies–despite the fact that texts have such high open and response rates.

Texts from insurance agencies are a direct line of communication to your existing policyholders and potential prospects. Here are some ways we’ve seen agents use them:

Send text message reminders

Chris Abrams, Founder of Abrams Insurance Solutions in San Diego, uses text message reminders to encourage action and ensure that his company’s messages actually get read. He updates clients about:

- Open enrollment dates and upcoming deadlines

- Payment reminders

- Appointment reminders

- Renewal reminders

Send personalized texts

As we’ve already mentioned, insurance is all about building relationships. Your customers want to know that you see them as people, not numbers, and value them.

Personalization in your texts can leave a major impression on your customers. That means including any details your customers have shared with you, like their names, locations, or birthdays. In fact, 97% of marketers have experienced a boost in business outcomes as a result of personalization.

Ask for online reviews

It’s become clear in recent years that customer reviews not only help build trust and local SEO rankings but can also help your conversion rate.

So, what role does SMS play in getting these reviews? Simple. With SMS, you can text existing and previous customers a link requesting a review.

Factor in the high click-through, open, and response rates we talked about, and you can be confident that your customers will follow through.

How to send a text blast with SimpleTexting

This quick video explains how easy it is to send a bulk message to a list of contacts using SimpleTexting.

In general, we recommend the following when writing insurance messages:

- Keep it short: Keeping a message as brief as possible allows the customer to scan it and respond before you lose their attention.

- Aim for clarity: Since SMS is short by nature, stick to the important details so the point of the message stays clear.

Must-have SMS features for insurance companies

When choosing an SMS tool for your marketing strategy, you’ll also want to have a “wish list” of features to check against the features each service offers.

Here are a few recommendations as you shop around:

- Keywords: Keywords are the best tool for getting as many contacts as possible from your campaigns, so make sure you can create as many as you need.

- Data Collection: This is just a series of questions you can set to send automatically to your contacts, allowing you to gather valuable information from them like their birthday, location, the type of policy they’re interested in, and more.

- Segments: You’ll use the data you collected to create contact segments or groups of contacts that have something in common. You can set up individual campaigns for each segment so your contacts only get the information and deals they want.

- Templates: Anyone who works with customers will tell you how often they answer the same questions throughout the day. Choose a service that lets you create templates so you can respond to FAQs with just a click.

Need help figuring out what else to look for in an SMS platform? Here’s a list of features to help guide you as you search.

Insurance texting FAQs

Is it legal to send marketing text messages?

Can insurance companies use text messages?

How do I market myself as an insurance agent?

Take the next step

That’s it—everything you need to know about SMS insurance marketing in one straightforward guide.

The next step is to sign up for a 14-day free trial and try it for yourself. You can also text or call us at (866) 450-4185 or use the chat at the bottom of your screen.

Try Our Insurance SMS Service for Free

No credit card required