What America’s Mobile Impulse Purchasing Habits Mean For Your Holiday Strategy

Targeted mobile ads find their way into every minute of our online experience. But how often are they making us pull the trigger on impulse purchases?

Targeted mobile ads find their way into every minute of our online experience. But how often are they making us pull the trigger on impulse purchases?

Impulse purchases used to be the exclusive domain of the grocery store check-out line, but as advertising evolved and companies gained direct access to consumers any time of day, that is no longer the case.

Targeted advertisements on search, social media, and texts often prompt Americans to purchase items a bit more impulsively than they otherwise would, especially while on the go. It was only a matter of time before impulsively buying a Snickers bar at checkout turned into a rash purchase of a brand-new TV, thanks to a flash sale you saw while scrolling through Instagram.

Always interested in where and how consumers learn about products and services, our team wanted to learn a little more about the ways Americans are impulse shopping.

We surveyed more than 2,900 people to find out more about their mobile impulse-purchasing habits, the websites where they make them, and which regions of the country will be impulse-purchasing the most this holiday season.

After seeing an advertisement for a product they want on their phone, 34% of Americans will purchase it within a day, while 1 in 5 will only wait a couple of hours at the most.

The decision to make an impulse purchase is often made quickly, but that doesn’t mean that the transaction will be completed. Our survey found that 53% of Americans have canceled a mobile impulse purchase before it shipped, and 51% have returned one after they received it.

Further, 1 in 10 Americans say that they regret over half of the impulse purchases they have made.

Whether regretted or not, mobile impulse purchases certainly have a financial impact. According to our survey, 10% of Gen Z respondents say mobile impulse purchases have either a “big” or “huge” impact on their wallets. Given the hefty impact impulse purchases can have on young people, it should come as no surprise that 77% of Gen Z also say they check their account balances before making one.

Online purchases aren’t always made during our proudest moments, either. For example, 30% of Americans have made a mobile impulse purchase while drunk, with nearly half of Millennials (47%) admitting to having done this before.

Given that, it shouldn’t be too surprising that 16% of Americans regularly hide their online purchases from the people they live with.

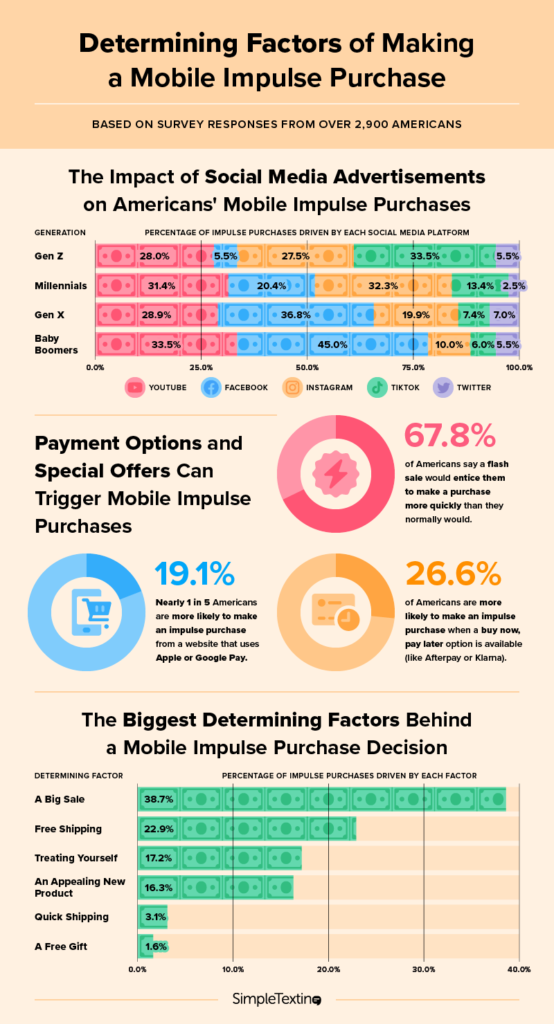

Most often, people interact with targeted ads on popular social media platforms. The platforms Americans are most likely to make a mobile impulse purchase on are YouTube (30%), Facebook (27%), and Instagram (22%).

There seems to be a pretty clear generational divide on this topic, though. Baby Boomers (45%) and Gen X (37%) are most likely to make a mobile impulse purchase on Facebook, while Millennials are most likely to make them on YouTube (31%) and Gen Z are most likely to make them on TikTok (34%).

Another factor that can impact our decision on whether to make a mobile impulse purchase is payment options. If a website offers a “buy now, pay later” (BNPL) option, like Afterpay or Klarna, 27% of Americans are more likely to make an impulse purchase. Millennials are particularly persuaded by BNPL, with 35% saying it makes them more likely to impulse purchase. Ease of checkout plays a role, too, as 19% of Americans are more likely to make a mobile impulse purchase if Apple or Google Pay is an option.

Advertisements aside, we asked Americans what the leading factors are behind their decision to make a mobile impulse purchase. The most common answers were a big sale (39%), free shipping (23%), and just being in the mood to treat themselves (17%).

With all of this in mind, websites that advertise big sales on YouTube and offer payment plans with few clicks needed are the mobile impulse-purchaser’s dream.

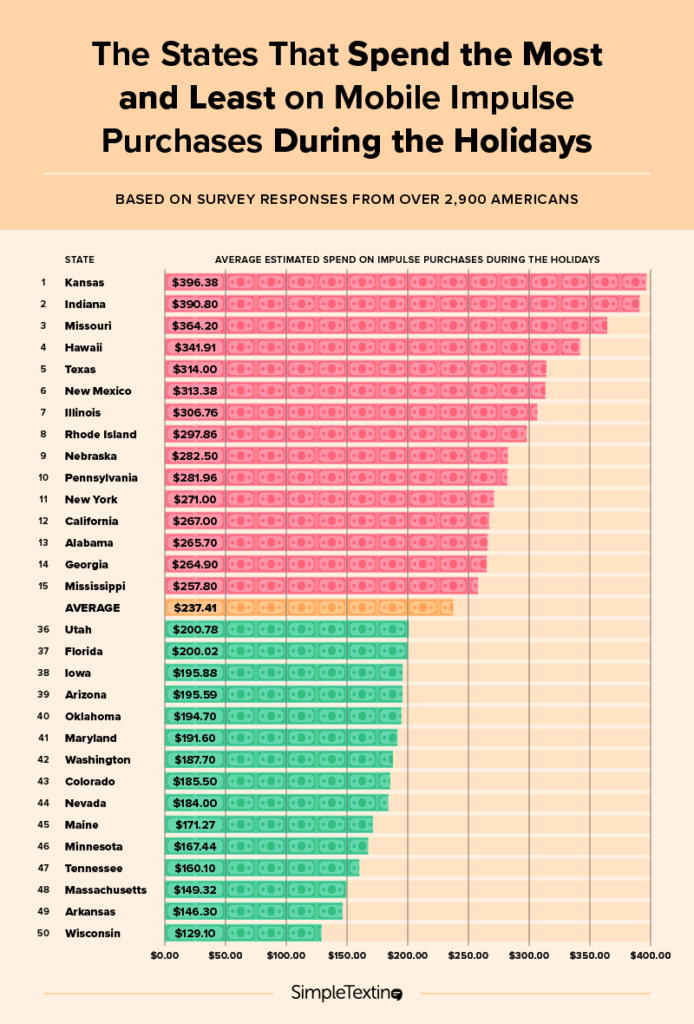

It’s no secret that advertisement frequency increases during the holiday season, and when companies are seeing more engagement from ads it’s no wonder why. To close out our survey, we wanted to take a look at which regions of the country spend the most on mobile impulse purchases during the season of 1,000 ads. We asked residents from each state to estimate how much they spend on mobile impulse purchases alone during the holiday season.

On average, Americans estimate their mobile impulse purchase spending during the holidays to be about $237 every year. Residents in Kansas seem to be the most likely to impulsively buy the season’s top-sellers, with an average spend at about $396, which is the most of any state and 67% more than the average. Indiana was right behind them at an average of $390.

While some parts of the country open their wallets on the holiday sales they come across scrolling through their phones, others exercise a bit more control. States like Arkansas and Massachusetts spend, on average, less than $150 on mobile impulse purchases during the holiday season every year. Wisconsin stands out from the rest, though, with residents estimating their spending at just $129, or 46% less than the average American.

Spending habits and impulsive purchases change regionally, but with people spending more time on their phones, the best new products and sales are sure to find their way into the hands of Americans everywhere.

Whether it’s a big splurge on a new product that caught your eye while scrolling through Instagram or a flash sale you received a text about from your favorite retailer, more and more of our transactions are taking place from the palms of our hands. Which often leads to impulse purchases being made by millions on the go.

Let’s be honest, though. Impulse purchases can be a mixed blessing for retailers. Yes, you want as many people as possible to buy your goods, but you probably aren’t keen on your customers having to hide the purchases from the people they live with, as we saw in the data.

If you’re recommending products or services that will enhance or improve your customers’ lives — and you aren’t using predatory marketing tactics — you can encourage quick-decision purchases while upholding ethical business standards.

And by encouraging impulse purchases in an empathetic way, you can maintain positive associations with your brand and reduce the amount of returns you receive from remorseful customers.

If you’re looking to get the most out of impulse purchase opportunities this holiday season, you can reach customers where they are with business text messaging.

To learn more about the mobile impulse purchasing habits of Americans, we conducted a survey where we asked respondents how much they typically spend around the holidays on impulse purchases, which products they’re most likely to purchase from their phones on impulse, and what the driving factors are behind any impulse purchase they make.

In total, we surveyed over 2,900 Americans. The survey was conducted over a two-week period in November 2022.

Dani Henion is the content team lead at SimpleTexting and is continuously looking for ways to make text messaging strategies and tips more accessible to SMBs. When she's not writing or planning new SMS content, you'll find her decorating elaborate sugar cookies or thrifting in Atlanta.

More Posts from Dani HenionUnsure of how to handle texting the wrong person? Use our guide to build the perfect follow-up text message.

ReadSince the first emoji was created in 1999, they have become a literal language of their own. Find out how to harness their power in your marketing messages.

ReadStart a text marketing campaign or have a 1-on-1 conversation today. It's risk free. Sign up for a free 14-day trial today to see SimpleTexting in action.

No credit card required