How Do Americans Transfer Money In 2020?

Transferring money is easier than ever thanks to new technology like cash apps. Our team surveyed average Americans to see how they transfer money in 2020!

Transferring money is easier than ever thanks to new technology like cash apps. Our team surveyed average Americans to see how they transfer money in 2020!

At SimpleTexting, we’re always interested to see how consumer behavior shifts from traditional to digital over time – and peer-to-peer transferring of money through mobile apps is no exception. Where transferring money used to be a tedious chore, requiring ATM withdrawals of cash or depositing a check at the bank, in 2020 it couldn’t be more simple. The growth of money-transfer, mobile apps such as Venmo and Square’s Cash App now make secure cash transfer a breeze for things like rent, craigslist finds, and paying friends back.

With the new cash app culture comes a whole slew of factors to consider: privacy settings, security, money-transfer etiquette, and more. To delve deeper into the topic, SimpleTexting surveyed 1,000 U.S. consumers between September 10th and September 12th across various demographics and all fifty states to uncover:

Read on to see the full survey results!

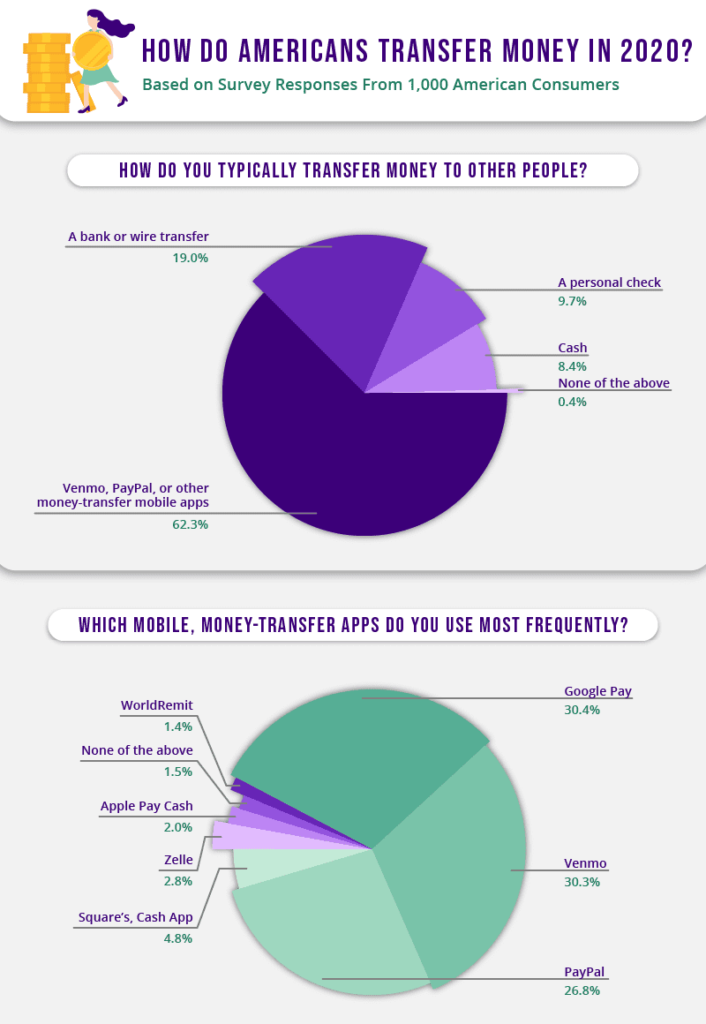

When asked how they typically transfer money to other people in 2020, 62% of survey respondents said through Venmo, PayPal, or other mobile, money-transfer apps. Only 9.7% said through personal check, and only 8.4% said through cash. Baby Boomers are the generation most likely to transfer money to others through personal checks according to survey responses.

Given the convenience of transferring money to friends, family members, or landlords through the click of a button while sitting on your couch, traditional means of money-transfer like checks or cash have become far less popular. When asked which cash apps are used most frequently, the largest amount of respondents said Google Pay (30.4%), Venmo (30.3%), and Paypal (26.8%).

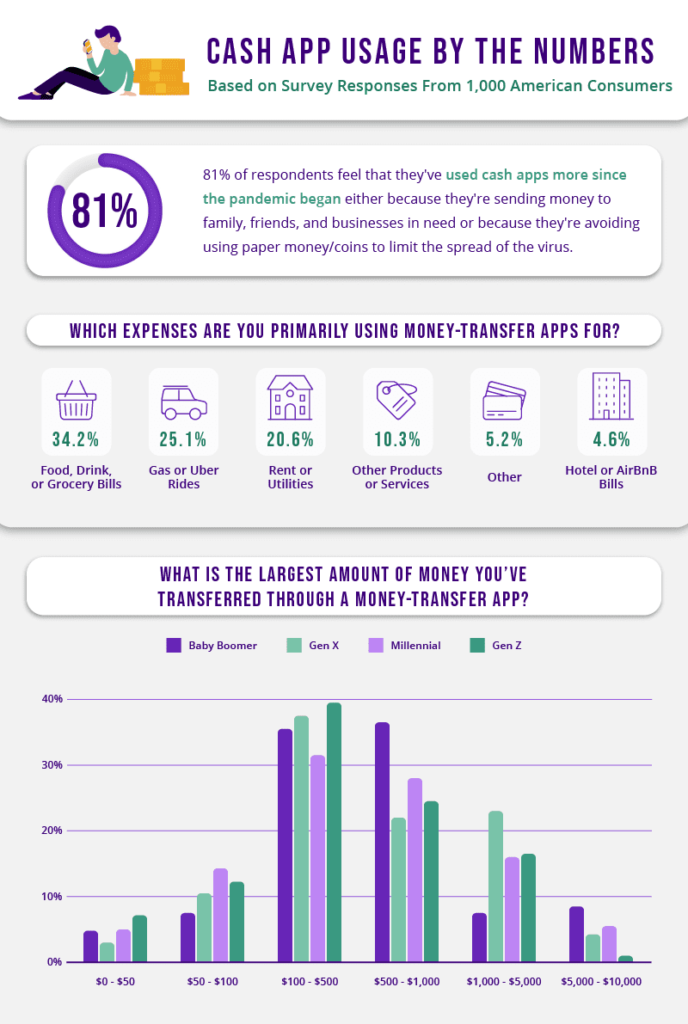

When asking about COVID-19’s impact on their money-transferring habits, the vast majority of respondents (81%) feel that they’ve used cash apps more since the pandemic began. 37% of respondents are using cash apps more in order to easily send/donate money to loved ones or small businesses in need during COVID-19, while 30% are for the purposes of contact-less payment in order to limit the spread of the virus.

According to survey results, consumers are using cash apps like Venmo primarily for splitting dinner or grocery bills among friends (34%), splitting gas or Uber expenses (25%), and paying for rent or utilities (21%). Online shopping or bills associated with vacations like hotel or Airbnb costs are other common reasons for using cash apps. Gone are the days of waiting weeks for your friends to pay you back after dinner or a road trip. With cash apps, paying someone back can happen in real-time, and consumers are certainly taking advantage.

Where a few years ago there may have been some hesitation in sending large amounts of money securely through mobile apps, in 2020, consumers overall feel very comfortable using apps like Venmo to send anywhere from $100 to $5,000. Per survey responses, 77% of respondents feel either “comfortable” or “very comfortable” transferring money through cash apps like Venmo. When asked about the largest amounts of money that have been transferred through a money-transfer app, 34% said they’ve transferred $100 to $500, and 27% said they’ve transferred as much as $500 to $1,000.

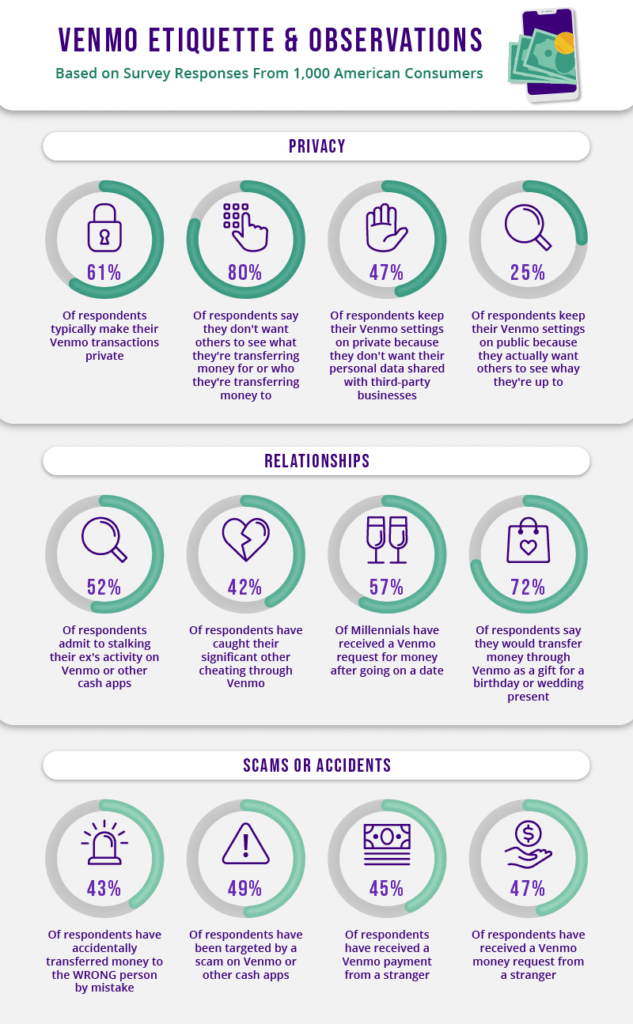

We were curious to find out what the collective underlying motivation is for making Venmo transactions private, public, or only visible to friends. The majority of respondents (61%) said they set their transactions to private, primarily because they don’t want others to see what they’re transferring money for or who they’re transferring money to. 47% keep their transactions private for fear of their personal data being shared with third-party businesses.

According to survey responses, a fair bit of investigation and stalking regularly occurs on Venmo, since public transactions of friends or mobile contacts appear on your personal feed – a feature that’s synonymous with Venmo’s brand strategy of being the “social network” for peer-to-peer money transfer. Over half of survey respondents admit to stalking their ex’s activity on Venmo, where Millennials are the main culprits. What’s more, 20% more males than females have stalked their ex’s activity on Venmo.

Surprisingly 42% of respondents have actually caught their significant other cheating through Venmo, and 57% of Millennials specifically have received a Venmo money request from someone that they went on a date with. Almost 60% of respondents overall have had someone “treat” them to a meal or drinks only to be faced with a Venmo money request from that same person the following day.

In terms of scams or accidents on Venmo, we all can admit to feeling slightly paranoid when we’re sending money for the first time to someone new. 43% of respondents said that they’ve accidentally transferred money to the wrong person by mistake, while almost half of respondents have been targeted by a scam on Venmo or other cash apps. A large portion of respondents, 47%, said that they’ve even received a money request by a complete stranger.

Overall, transferring money seems to be yet another prime example of how our society chiefly conducts life’s tasks through the phone, from mobile shopping and social media scrolling to texting with businesses and confirming restaurant reservations.

Seeking ways to more effectively reach your audience through the phone? Request a demo today to see how our text marketing services can help!

Meghan Tocci is a content strategist at SimpleTexting. When she’s not writing about SaaS, she’s trying to teach her puppy Lou how to code. So far, not so good.

More Posts from Meghan TocciSales is tough. If you’re nodding your head in agreement, it’s because you’ve experienced these 13 common sales problems.

ReadWe reached out to seven digital marketers across different industries to find out where email marketing fell short for them and what you can do about it.

ReadStart a text marketing campaign or have a 1-on-1 conversation today. It's risk free. Sign up for a free 14-day trial today to see SimpleTexting in action.

No credit card required