The only payment failure message templates you need

Not sure how to deal with a failed payment by a customer? Use these payment failure message templates to collect quickly and easily.

Not sure how to deal with a failed payment by a customer? Use these payment failure message templates to collect quickly and easily.

No matter what industry you’re in, payment failures are inevitable. But that doesn’t mean you should ignore them.

Businesses lose around 62% of customers who experience a failed payment. So, not only do you lose the revenue from each missed payment, but you also may lose out on future sales from those customers.

The stats speak for themselves: You need to actively reach out to clients and customers when their payment fails.

The good news is that payment failures can be remedied quickly and easily — in most cases, all you need to do is send a payment request.

Let the customer know that their payment failed and tell them how and when to complete it, and that’s it.

But striking the right tone when sending a payment failure message can be a challenge. To make your life easier, I’ll lay out ten payment failure messages you can use for inspiration.

TABLE OF CONTENTS

First off, it’s important to know why failed payments happen. Here are a few common reasons.

From short, to-the-point text messages to “friendly reminder” emails, there are a lot of ways you can communicate a payment failure.

Learning from popular brands and companies is a great way to better understand how to reach out to customers professionally.

The emails and text message examples below use a few different tactics to motivate customers to pay what they owe.

Given that many customers provide businesses with their email addresses, failed payment emails are a popular way to request payments.

Here are some of the most effective ways to help customers submit their payments.

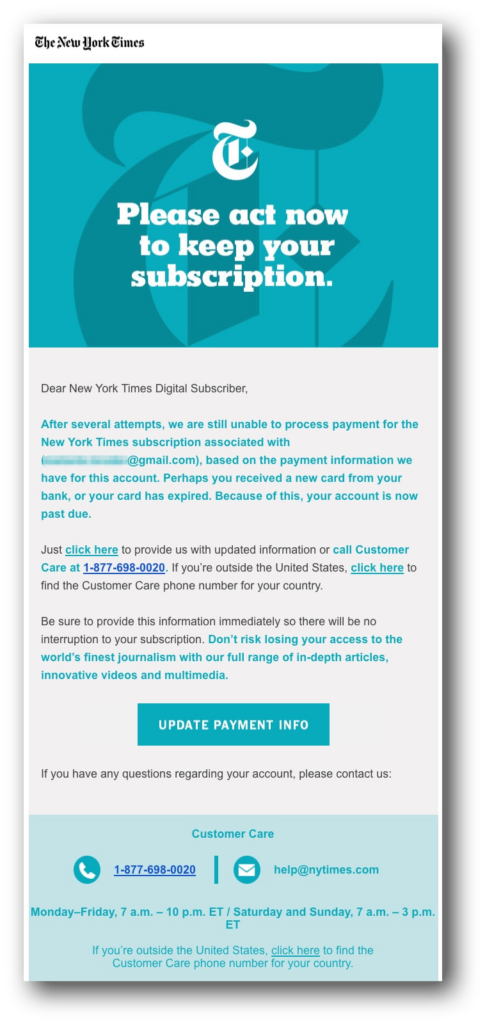

True to form, The New York Times is as direct as its journalism when it comes to missed payments. Here’s what this email does well.

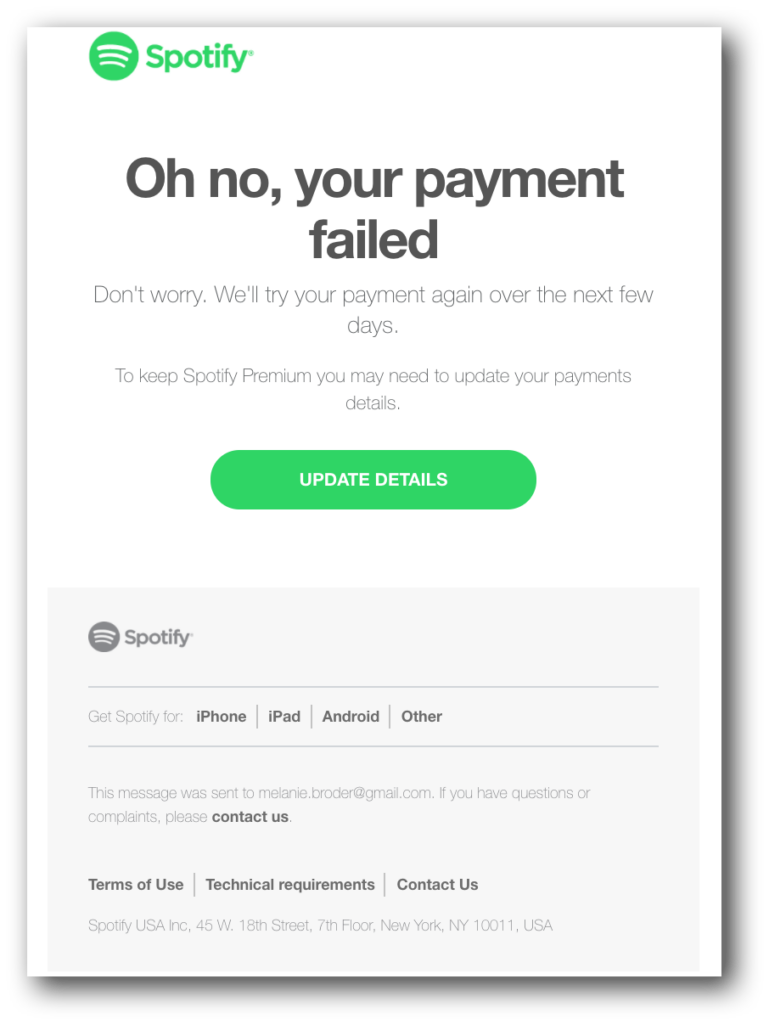

As a SaaS product, Spotify relies entirely on its customers paying monthly and annual memberships.

So, it’s no surprise that Spotify leads with a clear CTA and follows it up with a summary of how to keep the subscription active.

Once again, a button taking readers straight to a payment method update page makes it easy for even the busiest of customers to update their information.

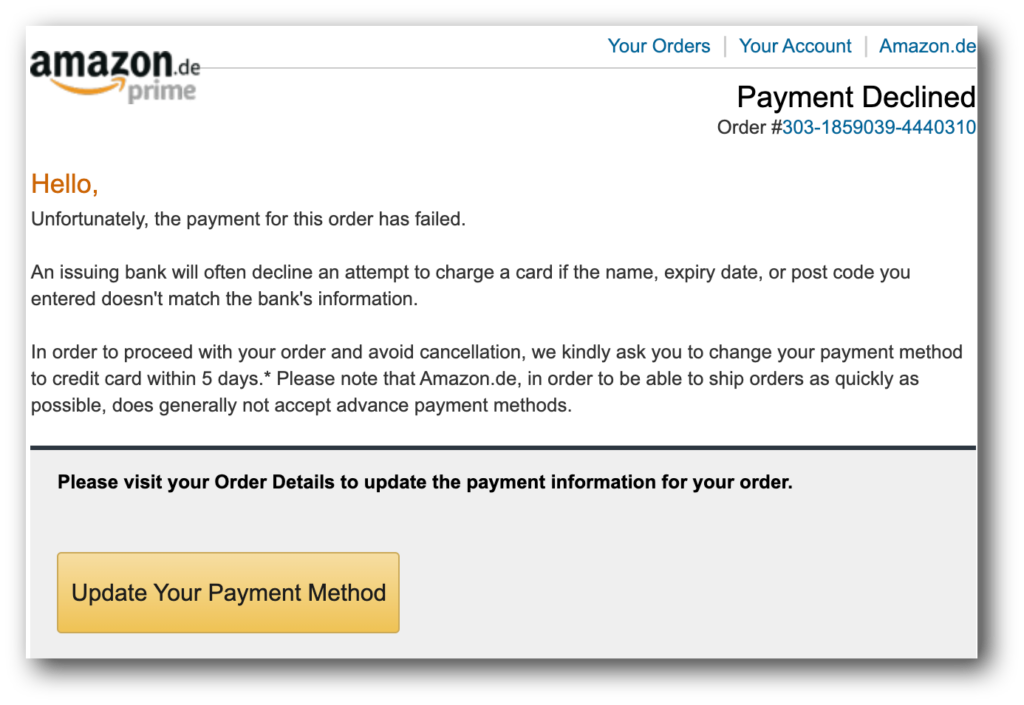

Even Amazon suffers from purchase failures thanks to customers’ cards declining.

Here, they send an instant email notification to let customers know their order has not been processed.

Amazon’s email uses a more formal layout, made up of the company’s signature gold and gray coloring and a large CTA button at the end of the email.

Even if a customer decides not to read the email, they know exactly what they need to do from the first line and the yellow button.

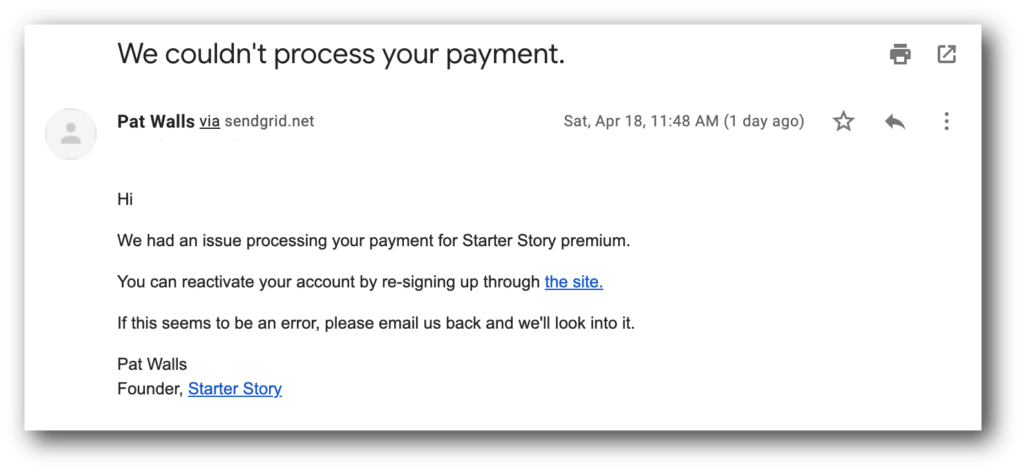

A branded email is not a must-have when it comes to collecting failed payments, especially for smaller businesses. Starter Story uses a simple, direct payment template notifying users of their account suspension.

For smaller businesses, signing off with the CEO or founder’s name can be an effective way to humanize the company and lend a personal touch.

If you’re a B2B company, targeting how your customer’s payment failure will impact their own business is an effective way to trigger action.

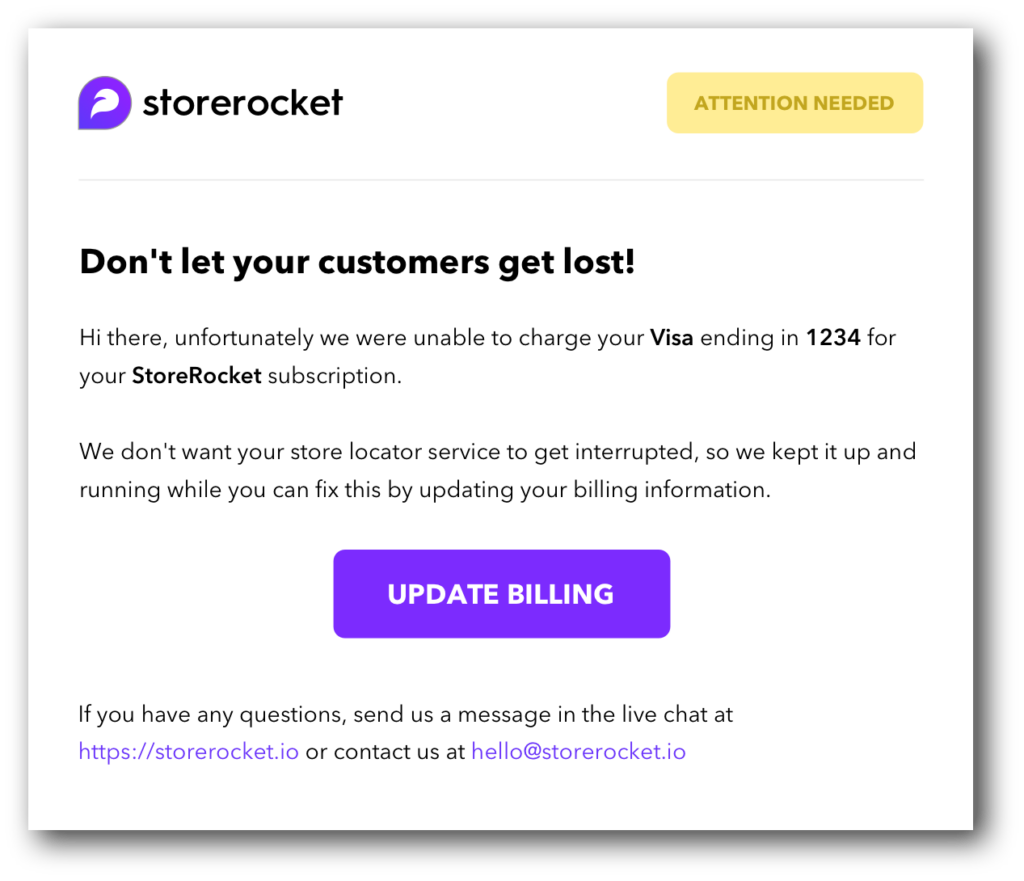

StoreRocket is a store locator software that reminds businesses of the importance of updating their payment information from the first line.

Instead of focusing on what the customer should do, it focuses the email on how not paying will have a negative effect on the customer’s business.

While emails are a popular way of sending payment reminders, the average open rate for emails is only 16.97%. When it comes to failed payments, the most effective method is the one your customers are guaranteed to open.

With a 98% open rate, text messages offer an alternative that can be used either independently, or together with, email.

By adding SMS to your failed payment strategy, your customers will have no excuse for not knowing that they need to update their payment information or missing an invoice.

If you’re struggling with inspiration, here are five examples you can use.

When a customer’s card is declined while shopping on your e-commerce site, it’s important to let them know immediately that money has not been taken from their account.

Avoid misinformation and make sure customers are aware that their order has not been confirmed by sending a text straight to their phone.

Include a link to make it easy for your customer to update their payment method and place the order again.

It’s important to remember that most payment failures don’t happen on purpose. Your customer or client’s card could have expired, they could have entered some information incorrectly, or they could have simply forgotten to move money into the correct account.

Whatever the reason, an informal approach will work for any customer who has accidentally forgotten to update their payment method.

Keep things light and make it clear that if they update their card details quickly, there’s no harm done.

Starting a text message with ‘uh oh’ isn’t for everyone. If you’re a bigger business (or it’s more in line with your brand voice), you may want to take a more direct approach.

This message template includes both the sum of the missed payment and a cancellation notice. This will remind customers that a payment failure has consequences if it’s not fixed quickly.

You can’t run a successful subscription business with constant payment interruptions.

Let the customer know which month’s payment they’ve missed to avoid any confusion, and send them a direct link to rectify the payment information as soon as possible.

Sometimes one message isn’t enough, but that doesn’t mean you should give up. After 3-5 business days, follow up on your original message to remind the customer of the consequences if they don’t pay.

Whether it’s a canceled subscription or membership suspension, give your customers a clear timeframe to remedy their payment failure and avoid the consequences.

Still have some questions about writing the perfect payment failure message? You’re not alone. Here are some of the most common questions surrounding payment failure notifications.

Don’t let your customers fall behind on paying you for your service. Both email and text message offer you direct ways to reach out to those whose payments have failed.

While both email and SMS are good outreach methods, I recommend using them together when it comes to payment failures. That way, customers will have a hard time not noticing your message.

Alice is a copywriter at SimpleTexting. When not teaching the world about the benefits of business texting, you can find her feeding family, friends and strangers with her latest baking experiment.

More Posts from Alice DoddCustomer retention is a crucial revenue generator that too many companies ignore. Here’s how VIP customer service can help.

ReadFrom the subtle art of smart upselling to tips and tricks for personalization. Learn how to optimize your customer service strategy to drive more sales.

ReadStart a text marketing campaign or have a 1-on-1 conversation today. It's risk free. Sign up for a free 14-day trial today to see SimpleTexting in action.

No credit card required